Currently, China’s industrial automation instrumentation field is primarily composed of three major camps: unicorn-led startups, publicly listed companies, and internet giants. These three camps are continuously expanding their presence in the industrial automation instrumentation sector, launching a series of products tailored to different application scenarios, covering various industry applications such as security, finance, and commerce.

Domestic and International Comparative Analysis:

The target customers for industrial automation instrumentation, both domestically and internationally, are primarily early-stage, specific industries with commercial potential. We are committed to providing them with the resources they lack in their early growth stages, helping them achieve rapid growth in commercial value. According to value chain management theory, the connotation of a business model can be divided into three dimensions: value positioning, value creation, value realization, and value delivery. Although there are universal core demands for these four dimensions in the industrial automation instrumentation sector both domestically and internationally, differences in systems, economies, and cultures lead to different exploration directions and implementation forms in the industry.

Internationally, the industrial automation instrumentation sector places more emphasis on maker culture and high-tech investment returns, tending to profit mainly through acquiring or selling corporate shares at a premium, thereby forming a sustainable self-service business capability through technological accumulation and project showcases. Domestically, the industrial automation instrumentation sector closely follows policy guidance and industry value positioning, setting expected development goals, accelerating resource exchange and focus through open collaboration among industry, academia, and research, and continuously accumulating resources and brand influence to create a snowball effect for enterprises.

Brand Competition Landscape Analysis:

In different application fields, the brand recognition in the industrial automation instrumentation industry varies. Based on the application dimensions of industrial automation instrumentation technology, it can be divided into government, enterprise, and individual consumers. Government departments generally aim to apply industrial automation instrumentation technology to smart security fields, where application scenarios are complex and precision requirements are high. Individual consumer application scenarios are less complex but demand higher consumer experience. According to the supply dimensions of industrial automation instrumentation technology, the products provided by this technology can be mainly divided into engineering projects, hardware technology, and software technology. As China’s economic growth enters a transition period, the development pace of the industrial automation instrumentation industry aligns with the national economic situation, shifting from high-speed to medium-to-low-speed development. After 30 years of rapid growth, China’s industrial automation instrumentation is facing a critical period of transformation and upgrading. The industry has entered an era of brand competition. Market competition in the industrial automation instrumentation sector has evolved from regional, categorical, and partial competition to a multidimensional contest between brands. Strengthening and accelerating brand building, establishing higher-level brand connotations, and achieving more efficient and systematic brand engineering have become essential paths for branded industrial automation instrumentation enterprises.

Competitive Intensity Analysis:

Competition Among Existing Enterprises in China’s Industrial Automation Instrumentation Industry:

Currently, there are not many companies in the industrial automation instrumentation industry, and each operates in different niche segments, resulting in relatively low competitive pressure among them.

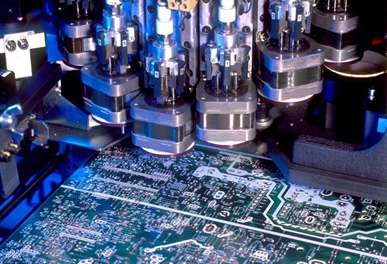

Bargaining Power of Upstream Suppliers in China’s Industrial Automation Instrumentation Industry: The main raw materials for the industrial automation instrumentation industry include electronic components, wires, computer accessories, packaging materials, etc. These products are mostly generic and standardized, with numerous suppliers and ample competition. Therefore, the industrial automation instrumentation industry has strong bargaining power upstream.

Bargaining Power of Downstream Users in China’s Industrial Automation Instrumentation Industry:

The downstream application entities of the industrial automation instrumentation industry include individuals, enterprises, and government institutions. Application fields encompass finance, security, industrial automation instrumentation, transportation, social entertainment, social security, etc. With a large number of downstream users, the industrial automation instrumentation industry holds significant bargaining power over its downstream users.

Threat Analysis of New Entrants in China’s Industrial Automation Instrumentation Industry:

New entrants bring new capacity and resources to the industrial automation instrumentation industry while also seeking to secure a position in a market already divided among existing companies. This could lead to competition with existing companies for raw materials and market share. Ultimately, the profitability of existing companies within the industrial automation instrumentation industry may decline.

Threat Analysis of Substitutes in China’s Industrial Automation Instrumentation Industry:

Companies within the same industry or from different industries may compete with each other if the products they produce can serve as substitutes for one another.

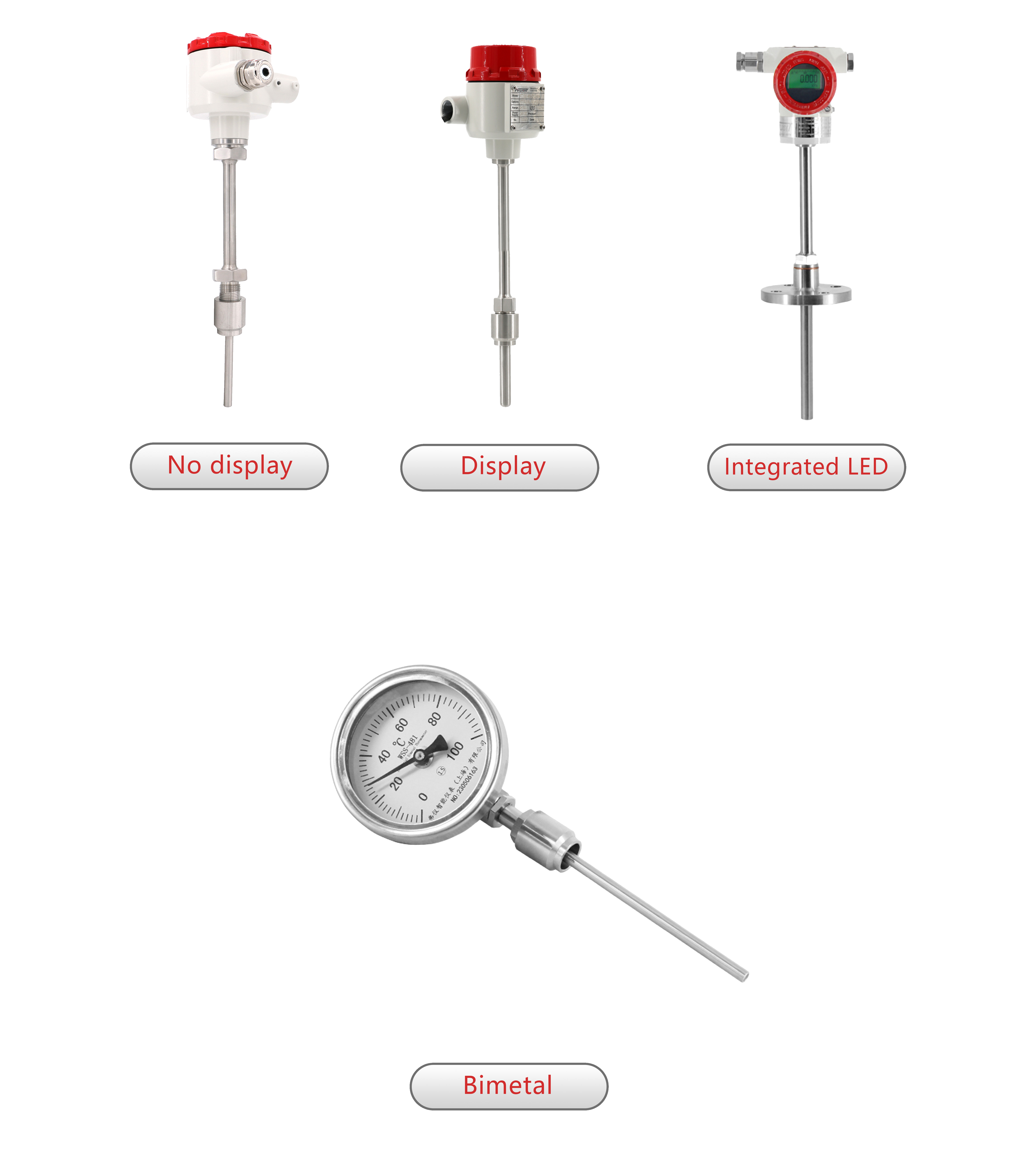

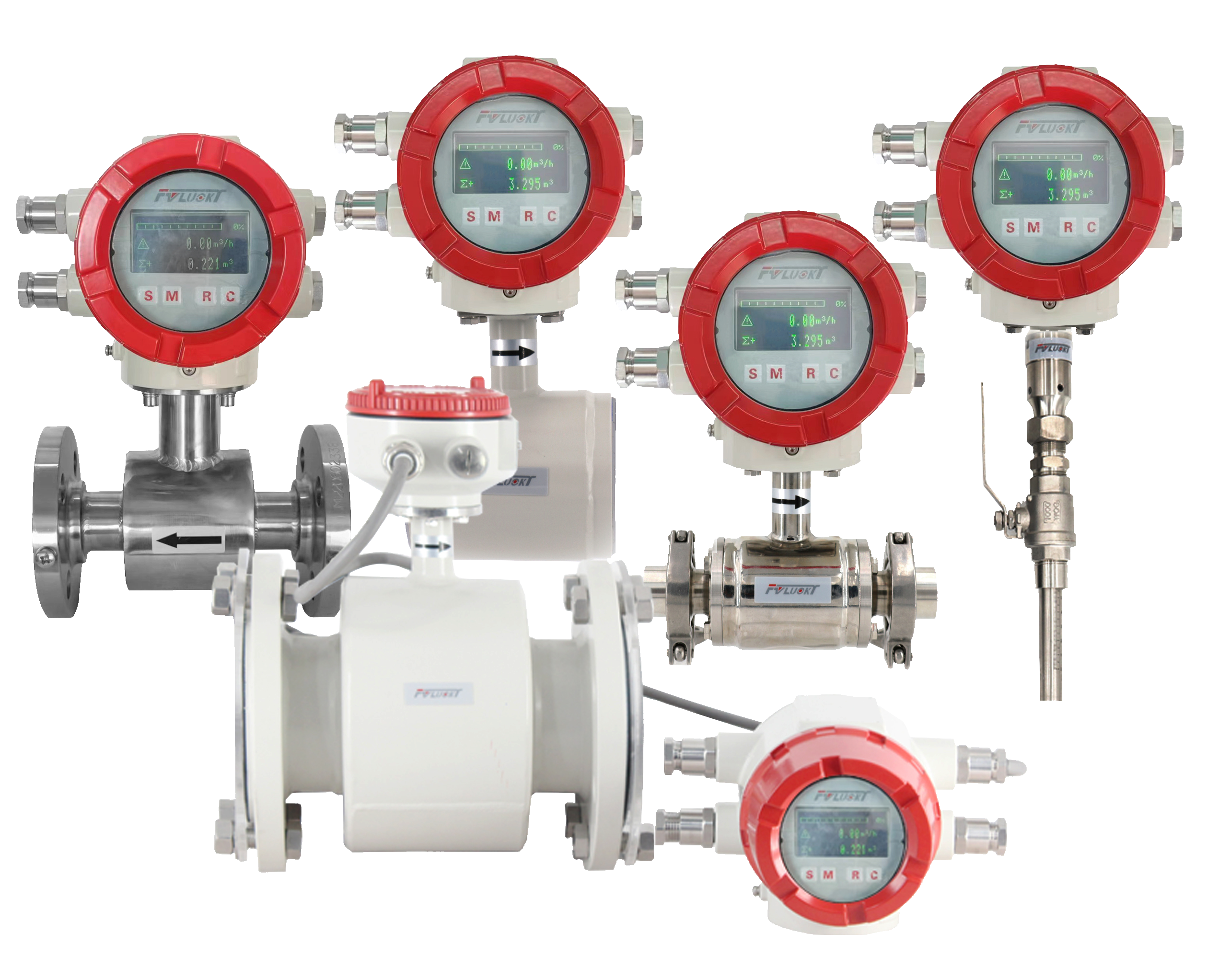

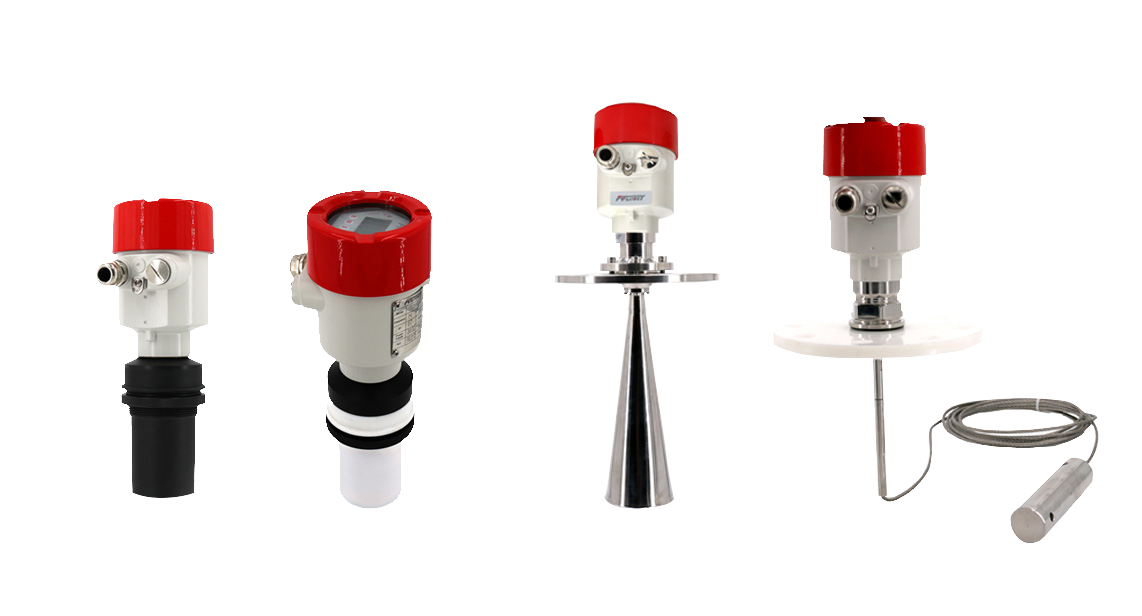

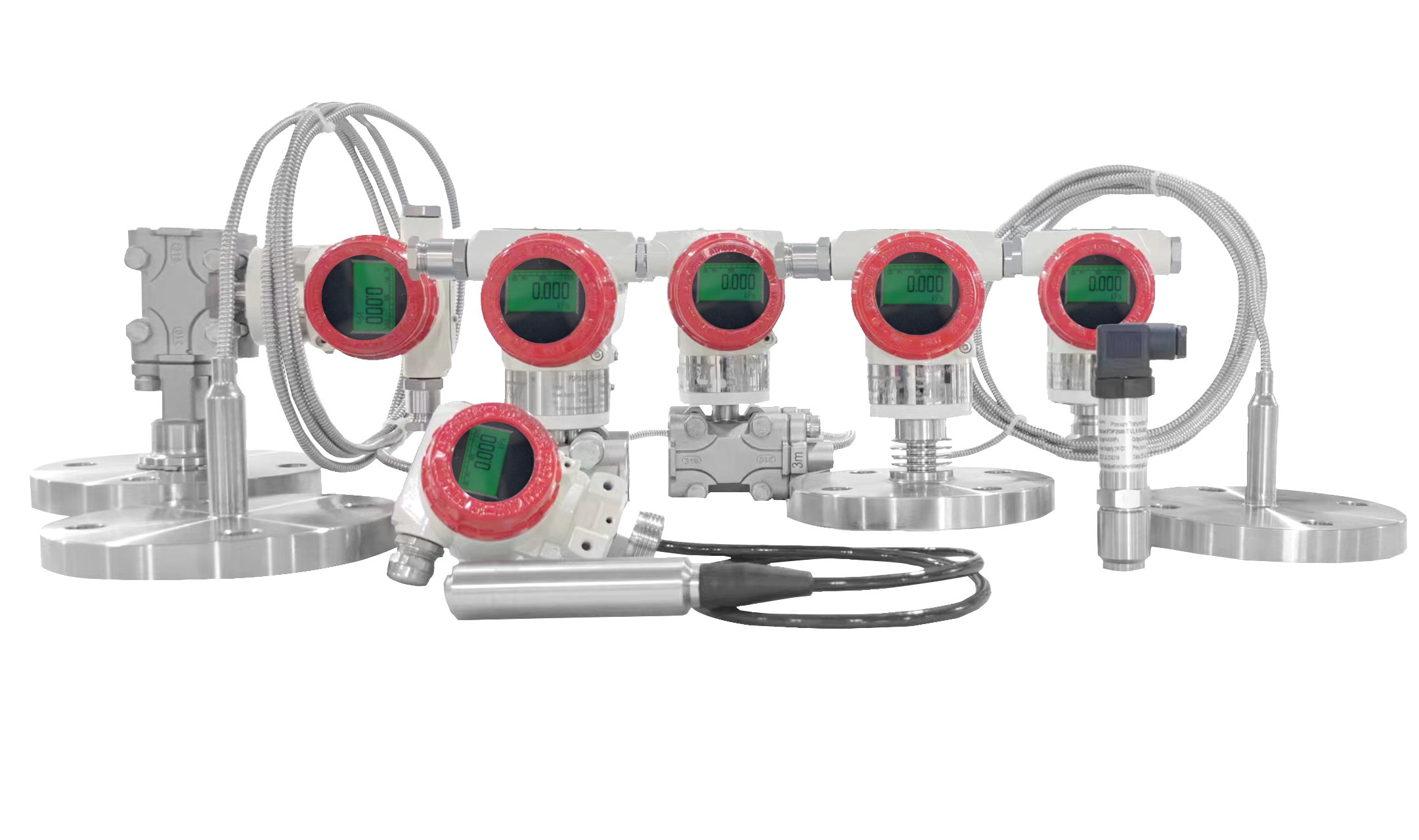

Popular Field Instruments

Other Field Instruments Articles

Smart Pressure Transmitters

Smart Pressure Transmitters